Module 30-36

Budget Balance

Difference between what the government spends and what the government brings in.

Major source of income is tax revenue.

Fiscal Policy

Will automatically adjust (automatic stabilizer).

- Government spending

- Tax revenue

Reduce the severity of recessions and inflations.

Monetary Policy

We've talked about RR, Dis. Rate, OMO.

We're now going to apply them towards fixing the economy.

Expansionary Monetary Policy

Increases the money supply to increase aggregate demand.

Increase government spending.

Runs the the budget towards a deficit (as you both are increasing spending as well as decreasing taxes).

Contractionary Monetary Policy

Decreases the money supply to decrease aggregate demand.

Money Market

By shifting the money supply, it changes the interest rate.

Expanding it will reduce the interest rate and make it cheaper to borrow, thus more spending.

Contracting it will increase the interest rate and make it more expensive to borrow, thus less spending.

Interest Sensitive Consumer Spending

Spending that requires a loan.

This will increase when the money supply increases.

Federals Fund Rate

The interest rate banks charge other banks for loans.

Two sources of inflation:

- Cost-Push inflation

- Caused by a significant increase in the cost of inputs.

- Demand-Pull inflation

- Caused by an increase in aggregate demand.

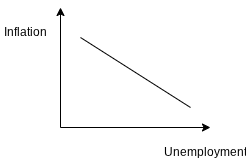

Phillip's Curve

In a Recession

- Government spending will automatically increase

- Because a government will increase its transfer payments.

- Unemployment benefits

- Because a government will increase its transfer payments.

- Tax revenue drops

In an Inflation

- Government spending will automatically drop

- Because a government will decrease its transfer payments.

- Few use unemployment benefits

- Because a government will decrease its transfer payments.

- Tax revenue increases

No, Congress should not be required to run an annual balanced budget.

The budget deficit will increase during recessions, and decrease during periods of economic expansions.

Cyclically adjusted.

Implicit Liability

Spending promised by governments. Not included in our debt statistics.

Inflation

Any change in the MS leads to a long-run change in the aggregate price level.

Inflation Tax

The depreciation in the real value of money as a result of inflation.

Increasing inflation = reduce money holdings.

Hyperinflation - when the price level increase dramatically, drastically.

Causes of Inflation

Cost-push inflation

A leftwards shift of the aggregate supply curve.

Demand-curve inflation

A rightwards shift of the aggregate demand curve.

What type of unemployment that exists in recessionary or inflationary? <- Exit Slip Question

Phillips Curve

A positive demand shock is going to shift you from which point to which point.

Economic Thoughts

Know the people credited with the school of economic thoughts, who was the proponent of it.

Classical:

- Adam Smith

- Laissez Faire - Hands-off policy (from the government)

- Say's Law - Economy is self-correcting.

- Prices are flexible

- Wages adjust

- Interest rates change

Keynesian

- John Maynard Keynes

- In essence, fiscal policy.

- Government has a responsibility to create a demand (all about demand)

- Through taxation and government spending

- President Kennedy was the first.

Monetarism

- Milton Friedman

- Anna Schwartz

- You add to the money supply.

Why is monetary advocated and pursued rather than fiscal? <- Test Question

Monetary makes small incremental changes, fiscal is large and lags.

Short run monetary policy resource question. REserach ample vs limited.

Ample - a lot of excess reserves to loan out, that the money supply is not the issue.

Limited reserves - when banks do not have excess reserves to loan out.

When a country has a banking system with the former, the type that will be used will be administrated interest rates.

With limited, the key tool is open market operations.