Warm-Ups

Warm-up One:

What does scarcity mean?

Something is scarce when it is desirable and limited. Scarcity occurs because people have unlimited wants, but limited resources to satisfy those wants.

What is the opportunity cost of taking an all expense Hawaii Vacation for Spring Break?

Opportunity cost is the "next best thing" that is given up when a decision is made. In this scenario, the opportunity cost could be a vacation with your family instead.

Identify the Normative Statement

- Inflation is not good for the economy

- Low unemployment is a good thing

- The government should pay for all junior college education

A positive statement has a definite, factual answer, and frequently features the word "is."

A normative statement does not have a definite answer, factual answer, and frequently features the word "should."

The normative statement is: The government should pay for all junior college education.

What is the labor force of the U.S. composed of?

The labor force is composed of the sum of those who are employed and unemployed. Or, in other words, those who are working for pay, and those who are looking for a job.

It excludes active duty, underaged, and those who are not seeking employment.

What does the business cycle illustrate for the U.S.?

The business cycle illustrates the movement of the economy, following its expansions, contractions (recessions), troughs, and peaks.

Warm-up Two:

Illustrate the circular flow of economic activity accurately. Explain the two markets within the economy and what each is doing.

Resource Markets:

Scarce resources owned and provided by consumers. They feature the Factors of Production: Capital, Entrepreneurship, Land, and Labor. It provides the resources for producers to produce goods and services.

Goods and Services

Provides the resources for consumers to produce the factors of production.

Warm-up Three:

Write a one page response summarizing a real-life event where you were in an economic situation. Be sure to highlight each of the lessons and how they played out in your real-life situation.

I had to find a solution for storing our family photos and videos. The primary scarcities were cost and time.

For this, I had two main choices: Use an existing online service, or to build my own local solution.

An online service required little time, but a great amount of monetary cost.

A local solution required a great amount of time, but far less monetary cost.

I ultimately went with the local solution, having the opportunity cost of time that could’ve been spent on other productive activities such as enjoying my winter break (which was at the time).

Warm-up Four:

What are the key economic concepts displayed in a PPC or PPF?

Scarcity, opportunity costs, trade-offs, and efficiency.

What does an outward shift of the curve represent?

Economic growth.

What does an inward shift of the curve represent?

Economic recession.

What does a point inside the curve represent?

Inefficient production.

Is a point outside of the curve possible under current circumstances?

No, because it is considered infeasible.

Warm-up Five:

What are the factors that would cause the demand curve to shift to the left for sweatshirts?

Consumer income (decreases), consumer tastes (decreases), substitutes (other decreases), number of consumers (decreases), complementary goods (other increases in price), price (decreases), and future expectations (future price increases).

If an increase in the price of gasoline results in a decrease in the demand for car tune-ups; what can we assume about the two goods and services?

They are complementary goods.

Assuming pizza is a normal good, an increase in income will do what to the demand for pizza?

The demand will increase because demand for normal goods are proportional to income.

If an increase in the price of string cheese leads to an increase in the demand for cheese sticks, what can we assume about the two products and which way would the demand curve shift for cheese sticks?

We can assume these products are supplementary, and the cheese sticks will shift towards the left.

When lumber costs fall, what happens to the supply of new construction?

The supply will increase due to a reduction in I: Input costs for producer.

A flood on the Oxnard Plain destroys the strawberry crop. What will happen to the supply of strawberries and what will happen to the price of strawberries at the market?

Supply will decrease due to W: Catastrophic weather event. The price will increase.

Draw a graph representing the market for semiconductors in the United States and show what happens when the government imposes a quota on imported semiconductors from Taiwan.

The supply curve will shift towards the left as supply decreases.

Draw a graph representing the market for electric cars in California and show what happens when a new technology reduces the cost of battery production.

The supply curve will shift towards the right as supply increases.

Warm-up Seven:

1. Who buys in the product market? What are they buying?

Households buy from the product market. They buy goods and services.

2. Who sells in the product market? What are they selling? What is their income called?

Firms sells in the product market. They sell goods and services. Their income is called revenue.

3. Who buys in the factor market? What are they buying?

Firms buy in the factor market. They buy the factors of production (land, labor, capital, and entrepreneurship).

4. Who sells in the factor market? What are they selling? What is their income called?

Households sells in the factor market. They sell the factors of production (land, labor, capital, and entrepreneurship). Their income is called wages, rent, profit, and interest.

Money is always clockwise (on the inside). Factors and services will always be moving counterclockwise.

Warm-up Eight:

- List and describe the three economic goals of a market economy.

1> Sustained long run economic growth.

This describes maintaining a consistent, positive rate of growth.

2> Low unemployment ~4%

This describes maintaining a workforce that is large enough such that the economy is running efficiently, but maintaining a large enough labor pool such that economic expansion is possible through pulling from the labor pool.

3> Keep prices stable ~2-3% inflation.

Keeping prices stable prevents prices from outpacing consumer spending. Otherwise, the purchasing power of consumers could collapse, dramatically slowing the economy.

- What is the importance of calculating GDP?

Compare our economic growth.

Determine if our economic policies are effective.

- Why is low unemployment a desired goal?

Low unemployment enable the economy to operate efficiently.

- Why is inflation above 4% a bad thing?

Inflation above 4% means the average price of goods is increasing substantially per year. This can outpace household spending power, leading to a decline in the economy.

- In the circular flow diagram, what do firms and businesses supply to households? What do households supply to businesses?

Firms and businesses supply goods and services to households. Households supply factors of production for businesses.

- What are the four components of GDP? What category does the construction of new homes and office buildings fall in?

The four components of GDP are: CIGXn - Consumer spending, Investments, Government spending, and net exports.

The construction of new homes and office buildings fall into investments.

Warm-up Ten:

A country has a working age population of 250 million, 185 million people with jobs, and 15 million people unemployed and seeking employment.

- What is the labor force? What is the labor force participation rate? What is the unemployment rate?

How can the UE rate be overstated? Understated?- Labor force = 185 million + 15 million = 200 million. Labor force participation rate = 200 million / 250 million = 80%.

- Unemployment rate = 15 million / 200 million = 7.50%.

- The unemployment rate can be overstated because the unemployment rate includes those who are easily employable, but are unemployed because they are searching for the right job.

- The unemployment rate can be understated because it excludes discouraged workers, under-employed individuals, and marginally attached workers.

- What is the relationship between the business cycle and employment?

- Employment has a proportional relationship with the business cycle. When the business cycle is in an expansion or peak, employment is high; when the business cycle is in a contraction or trough, the employment is low.

- It is inversely proportional to cyclical unemployment.

- Employment has a proportional relationship with the business cycle. When the business cycle is in an expansion or peak, employment is high; when the business cycle is in a contraction or trough, the employment is low.

Warm-up Eleven:

-

How do you calculate the natural rate of unemployment?

The natural rate of unemployment is the sum of structural and frictional unemployment.

-

What factors can increase/decrease the natural rate of unemployment?

Efficiency wages, minimum wages, unions, government policies, subsidies, and an increase or decrease in the number of jobs can all increase or decrease the natural rate of unemployment.

Add. Internet-based job search, job training.

-

Jeff was recently laid off from his job. He looked for work for 3 months and found nothing suitable. He now volunteers at a food bank. What is he classified as?

He is classified as out of the labor force/a discouraged worker because he is not receiving a wage for his contributions nor is he actively looking for a job.

-

Jasmine recently quit her job at the local bakery and has been browsing the internet for jobs, but hasn’t found anything that matches her skills? What is she classified as?

She is classified as frictionally unemployed due to the mismatch of skill and skill demanded.

Warm-up twelve:

- If the MPC is 0.6 and the government increases spending by 1.2 trillion, what will be the change in rGDP?

rGDP = multiplier * change in spending

= 1/(1-0.6) * change in spending

= 1/0.4 * change in spending

= 3 trillion dollars

- Suppose the consumer spending increases by 25 billion, and as a result the equilibrium income (GDP) increases by 125 billion. What is the value of the MPC.

rGDP = 1/(1-MPC) * change in spending

125 = 1/(1-MPC) * 25

5 = 1/(1-MPC)

1/5 = 1-MPC

MPC = 4/5 = 0.8

- Frederico earns $90,000 at his job. He gets a $6,000 raise. What % raise did he receive? When he was given this raise, his spending want from 90,000 to 92,000. Calculate Frederico's MPC and MPS.

% raise = (96000-90000)/90000 = 6.67%

MPC = 2000/6000 = 1/3 = 0.33

MPS = 1-MPC = 0.67

- What does the consumption function show us? What will shift the consumption function upward?

The consumption function shows the relationship between disposable income and consumer spending. If your disposable income increases, you consumer spending will also increase.

Two factors shift the consumption function: Changes in wealth, and changes in expectations of future income.

Warm-up Thirteen:

- What is the interest rate effect on Aggregate demand in response to a change in the aggregate price level in the economy?

The interest rate effect helps prove the aggregate demand curve is downwards sloping. i.e. when the price level decreases, the aggregate demand increases.

This is because an increase an in price level leads to a lower purchasing power for individuals. This causes individuals to increase their money holdings, and thus increase interest rates (by making less money available to be loaned). This in turn decreases the incentive to do investment spending, and thus causes a negative sloping curve.

The other effect, the wealth effect, is because an increase in price level leads to a lower purchasing power for individuals, they are less likely to do consumer spending. This in turn causes the associated negative sloping curve.

An increase in the aggregate price level, results in an increase in the demand of money, which in turns increases the interest rate, which in turn in turn decreases consumer spending, and thus the aggregate output decreases.

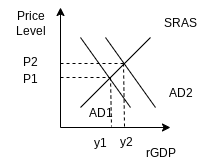

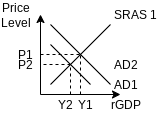

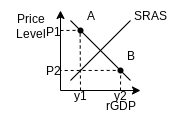

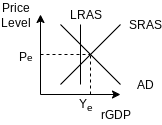

- Draw a correctly labeled graph to show the impact of an increase in wealth on aggregate demand.

- What happens to the quantity of aggregate output demanded when the price level falls?

It will increase.

Warm-up Fourteen:

-

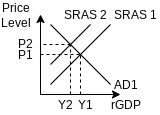

Draw a correctly labeled graph and explain how a decrease in wages will impact aggregate supply.

A decrease in wages will cause a positive aggregate supply shock.

-

List the factors that will increase and decrease AS in the macroeconomy.

- PEAR

- Productivity

- Inflation expectations

- Action by the government

- Business taxes

- Government subsidies

- Resource costs

- Wages

- Input Costs

- PEAR

-

In the long-run, what effect does price level have on the quantity of aggregate output in the macroeconomy?

- Price level has no effect on the quantity of aggregate output. They always move in the same direction because changes in wages and prices will counter its effects.

-

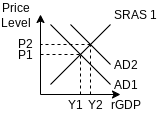

Increased consumption will shift the __________ to the _______. Draw a graph that displays this.

- aggregate demand; right

-

An increase in interest rates leads to a(n) __________ in the price level and a(n) ________ in real GDP. Graph it.

- decrease; decrease

-

What are demand shocks and what do they create. How are these demand shocks able to self-correct?

- Demand shocks are shifts of the aggregate demand curve to the left or right. They can create inflationary or recessionary gaps.

- Self corrected:

- Price level changes --- positive demand shocks has created an increase in price level.

- Wage level changes --- an increase in price level has created an increase in wages.

- SRAS level changes --- an increase in wages will decrease/shift the SRAS towards the left.

- A positive demand shocks is self-corrected with a negative supply shock, and vise versa.

- Demand shocks are corrected without any government intervention thanks to a shift in the supply curve due to price level and wage level changes.

Warm-up Fifteen:

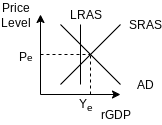

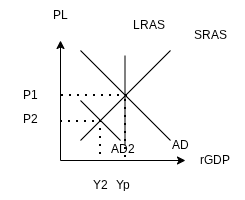

- Draw a correctly labeled AD-AS graph and illustrate an inflationary gap. How could fiscal policy be used to close the inflationary gap.

Fiscal policy such as a decrease in government spending, or an increase in income taxes can help shift the demand curve towards the left, moving the equilibrium point between the AD and SRAS back to an intersection with the LRAS.

-

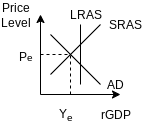

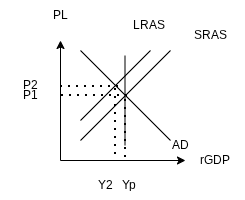

Draw a correctly labeled AD-AS graph and illustrate a recessionary gap. How could fiscal policy be used to close the recessionary gap.

Warm-up One:

What does scarcity mean?

Something is scarce when it is desirable and limited. Scarcity occurs because people have unlimited wants, but limited resources to satisfy those wants.

What is the opportunity cost of taking an all expense Hawaii Vacation for Spring Break?

Opportunity cost is the "next best thing" that is given up when a decision is made. In this scenario, the opportunity cost could be a vacation with your family instead.

Identify the Normative Statement

- Inflation is not good for the economy

- Low unemployment is a good thing

- The government should pay for all junior college education

A positive statement has a definite, factual answer, and frequently features the word "is."

A normative statement does not have a definite answer, factual answer, and frequently features the word "should."

The normative statement is: The government should pay for all junior college education.

What is the labor force of the U.S. composed of?

The labor force is composed of the sum of those who are employed and unemployed. Or, in other words, those who are working for pay, and those who are looking for a job.

It excludes active duty, underaged, and those who are not seeking employment.

What does the business cycle illustrate for the U.S.?

The business cycle illustrates the movement of the economy, following its expansions, contractions (recessions), troughs, and peaks.

Warm-up Two:

Illustrate the circular flow of economic activity accurately. Explain the two markets within the economy and what each is doing.

Resource Markets:

Scarce resources owned and provided by consumers. They feature the Factors of Production: Capital, Entrepreneurship, Land, and Labor. It provides the resources for producers to produce goods and services.

Goods and Services

Provides the resources for consumers to produce the factors of production.

Warm-up Three:

Write a one page response summarizing a real-life event where you were in an economic situation. Be sure to highlight each of the lessons and how they played out in your real-life situation.

I had to find a solution for storing our family photos and videos. The primary scarcities were cost and time.

For this, I had two main choices: Use an existing online service, or to build my own local solution.

An online service required little time, but a great amount of monetary cost.

A local solution required a great amount of time, but far less monetary cost.

I ultimately went with the local solution, having the opportunity cost of time that could’ve been spent on other productive activities such as enjoying my winter break (which was at the time).

Warm-up Four:

What are the key economic concepts displayed in a PPC or PPF?

Scarcity, opportunity costs, trade-offs, and efficiency.

What does an outward shift of the curve represent?

Economic growth.

What does an inward shift of the curve represent?

Economic recession.

What does a point inside the curve represent?

Inefficient production.

Is a point outside of the curve possible under current circumstances?

No, because it is considered infeasible.

Warm-up Five:

What are the factors that would cause the demand curve to shift to the left for sweatshirts?

Consumer income (decreases), consumer tastes (decreases), substitutes (other decreases), number of consumers (decreases), complementary goods (other increases in price), price (decreases), and future expectations (future price increases).

If an increase in the price of gasoline results in a decrease in the demand for car tune-ups; what can we assume about the two goods and services?

They are complementary goods.

Assuming pizza is a normal good, an increase in income will do what to the demand for pizza?

The demand will increase because demand for normal goods are proportional to income.

If an increase in the price of string cheese leads to an increase in the demand for cheese sticks, what can we assume about the two products and which way would the demand curve shift for cheese sticks?

We can assume these products are supplementary, and the cheese sticks will shift towards the left.

When lumber costs fall, what happens to the supply of new construction?

The supply will increase due to a reduction in I: Input costs for producer.

A flood on the Oxnard Plain destroys the strawberry crop. What will happen to the supply of strawberries and what will happen to the price of strawberries at the market?

Supply will decrease due to W: Catastrophic weather event. The price will increase.

Draw a graph representing the market for semiconductors in the United States and show what happens when the government imposes a quota on imported semiconductors from Taiwan.

The supply curve will shift towards the left as supply decreases.

Draw a graph representing the market for electric cars in California and show what happens when a new technology reduces the cost of battery production.

The supply curve will shift towards the right as supply increases.

Warm-up Seven:

1. Who buys in the product market? What are they buying?

Households buy from the product market. They buy goods and services.

2. Who sells in the product market? What are they selling? What is their income called?

Firms sells in the product market. They sell goods and services. Their income is called revenue.

3. Who buys in the factor market? What are they buying?

Firms buy in the factor market. They buy the factors of production (land, labor, capital, and entrepreneurship).

4. Who sells in the factor market? What are they selling? What is their income called?

Households sells in the factor market. They sell the factors of production (land, labor, capital, and entrepreneurship). Their income is called wages, rent, profit, and interest.

Money is always clockwise (on the inside). Factors and services will always be moving counterclockwise.

Warm-up Eight:

- List and describe the three economic goals of a market economy.

1> Sustained long run economic growth.

This describes maintaining a consistent, positive rate of growth.

2> Low unemployment ~4%

This describes maintaining a workforce that is large enough such that the economy is running efficiently, but maintaining a large enough labor pool such that economic expansion is possible through pulling from the labor pool.

3> Keep prices stable ~2-3% inflation.

Keeping prices stable prevents prices from outpacing consumer spending. Otherwise, the purchasing power of consumers could collapse, dramatically slowing the economy.

- What is the importance of calculating GDP?

Compare our economic growth.

Determine if our economic policies are effective.

- Why is low unemployment a desired goal?

Low unemployment enable the economy to operate efficiently.

- Why is inflation above 4% a bad thing?

Inflation above 4% means the average price of goods is increasing substantially per year. This can outpace household spending power, leading to a decline in the economy.

- In the circular flow diagram, what do firms and businesses supply to households? What do households supply to businesses?

Firms and businesses supply goods and services to households. Households supply factors of production for businesses.

- What are the four components of GDP? What category does the construction of new homes and office buildings fall in?

The four components of GDP are: CIGXn - Consumer spending, Investments, Government spending, and net exports.

The construction of new homes and office buildings fall into investments.

Warm-up Ten:

A country has a working age population of 250 million, 185 million people with jobs, and 15 million people unemployed and seeking employment.

- What is the labor force? What is the labor force participation rate? What is the unemployment rate?

How can the UE rate be overstated? Understated?- Labor force = 185 million + 15 million = 200 million. Labor force participation rate = 200 million / 250 million = 80%.

- Unemployment rate = 15 million / 200 million = 7.50%.

- The unemployment rate can be overstated because the unemployment rate includes those who are easily employable, but are unemployed because they are searching for the right job.

- The unemployment rate can be understated because it excludes discouraged workers, under-employed individuals, and marginally attached workers.

- What is the relationship between the business cycle and employment?

- Employment has a proportional relationship with the business cycle. When the business cycle is in an expansion or peak, employment is high; when the business cycle is in a contraction or trough, the employment is low.

- It is inversely proportional to cyclical unemployment.

- Employment has a proportional relationship with the business cycle. When the business cycle is in an expansion or peak, employment is high; when the business cycle is in a contraction or trough, the employment is low.

Warm-up Eleven:

-

How do you calculate the natural rate of unemployment?

The natural rate of unemployment is the sum of structural and frictional unemployment.

-

What factors can increase/decrease the natural rate of unemployment?

Efficiency wages, minimum wages, unions, government policies, subsidies, and an increase or decrease in the number of jobs can all increase or decrease the natural rate of unemployment.

Add. Internet-based job search, job training.

-

Jeff was recently laid off from his job. He looked for work for 3 months and found nothing suitable. He now volunteers at a food bank. What is he classified as?

He is classified as out of the labor force/a discouraged worker because he is not receiving a wage for his contributions nor is he actively looking for a job.

-

Jasmine recently quit her job at the local bakery and has been browsing the internet for jobs, but hasn’t found anything that matches her skills? What is she classified as?

She is classified as frictionally unemployed due to the mismatch of skill and skill demanded.

Warm-up twelve:

- If the MPC is 0.6 and the government increases spending by 1.2 trillion, what will be the change in rGDP?

rGDP = multiplier * change in spending

= 1/(1-0.6) * change in spending

= 1/0.4 * change in spending

= 3 trillion dollars

- Suppose the consumer spending increases by 25 billion, and as a result the equilibrium income (GDP) increases by 125 billion. What is the value of the MPC.

rGDP = 1/(1-MPC) * change in spending

125 = 1/(1-MPC) * 25

5 = 1/(1-MPC)

1/5 = 1-MPC

MPC = 4/5 = 0.8

- Frederico earns $90,000 at his job. He gets a $6,000 raise. What % raise did he receive? When he was given this raise, his spending want from 90,000 to 92,000. Calculate Frederico's MPC and MPS.

% raise = (96000-90000)/90000 = 6.67%

MPC = 2000/6000 = 1/3 = 0.33

MPS = 1-MPC = 0.67

- What does the consumption function show us? What will shift the consumption function upward?

The consumption function shows the relationship between disposable income and consumer spending. If your disposable income increases, you consumer spending will also increase.

Two factors shift the consumption function: Changes in wealth, and changes in expectations of future income.

Warm-up Thirteen:

- What is the interest rate effect on Aggregate demand in response to a change in the aggregate price level in the economy?

The interest rate effect helps prove the aggregate demand curve is downwards sloping. i.e. when the price level decreases, the aggregate demand increases.

This is because an increase an in price level leads to a lower purchasing power for individuals. This causes individuals to increase their money holdings, and thus increase interest rates (by making less money available to be loaned). This in turn decreases the incentive to do investment spending, and thus causes a negative sloping curve.

The other effect, the wealth effect, is because an increase in price level leads to a lower purchasing power for individuals, they are less likely to spend. This in turn causes the associated negative sloping curve.

An increase in the aggregate price level, results in an increase in the demand of money, which in turns increases the interest rate, which in turn in turn decreases consumer spending, and thus the aggregate output decreases.

- Draw a correctly labeled graph to show the impact of an increase in wealth on aggregate demand.

- What happens to the quantity of aggregate output demanded when the price level falls?

It will increase.

Warm-up Fourteen:

-

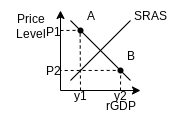

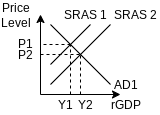

Draw a correctly labeled graph and explain how a decrease in wages will impact aggregate supply.

A decrease in wages will cause a positive aggregate supply shock.

-

List the factors that will increase and decrease AS in the macroeconomy.

- PEAR

- Productivity

- Inflation expectations

- Action by the government

- Business taxes

- Government subsidies

- Resource costs

- Wages

- Input Costs

- PEAR

-

In the long-run, what effect does price level have on the quantity of aggregate output in the macroeconomy?

- Price level has no effect on the quantity of aggregate output. They always move in the same direction because changes in wages and prices will counter its effects.

- LRAS is verticle.

-

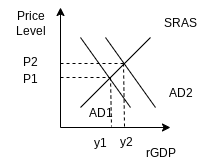

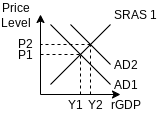

Increased consumption will shift the __________ to the _______. Draw a graph that displays this.

- aggregate demand; right

-

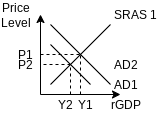

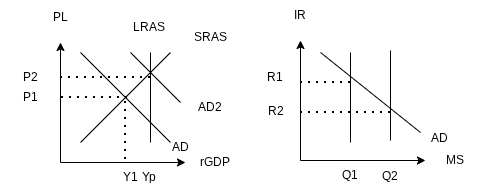

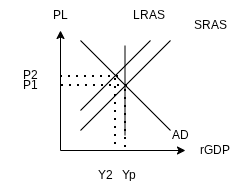

An increase in interest rates leads to a(n) __________ in the price level and a(n) ________ in real GDP. Graph it.

- decrease; decrease

-

What are demand shocks and what do they create. How are these demand shocks able to self-correct?

- Demand shocks are shifts of the aggregate demand curve to the left or right. They can create inflationary or recessionary gaps.

- Self corrected:

- Price level changes --- positive demand shocks has created an increase in price level, which in turn drives up inflation.

- Wage level changes --- an increase in inflation has created an increase in wages.

- SRAS level changes --- an increase in wages will decrease/shift the SRAS towards the left.

- A positive demand shocks is self-corrected with a negative supply shock, and vise versa.

- Demand shocks are corrected without any government intervention thanks to a shift in the supply curve due to price level and wage level changes.

Warm-up Fifteen:

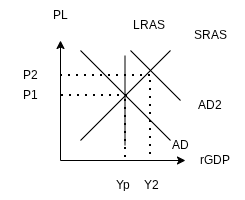

- Draw a correctly labeled AD-AS graph and illustrate an inflationary gap. How could fiscal policy be used to close the inflationary gap.

Aggregate demand causes these gaps!

Fiscal policy such as an increase in government spending (direct), or a decrease in income taxes (indirect) can help shift the demand curve towards the rught, moving the equilibrium point between the AD and SRAS back to an intersection with the LRAS.

-

Government decides to increase spending on military equipment by 50 billion. Using the spending multiplier and assuming MPC of 0.6, what is the change in real GDP?

rGDP = 1/(1-MPC) * spending

= 1/(0.4) * 50

= 125 billion dollars.

Warm-up Sixteen:

- What are the three tasks of the financial system?

- Reduce transaction costs

- Reduce financial risk

- Provide liquidity

- What are the 4 types of financial assets?

- Bonds

- An IOU issued by the borrower.

- Loans

- A lending agreement between an individual lender (asset) and an individual borrower (liability).

- Stocks

- A share in the ownership of a company.

- Bank deposits

- What is a financial intermediary and what do they do in the macroeconomy?

- Financial intermediaries are institutions that transform the funds it gathers from many individuals into financial assets.

- Mutal Funds - Portfolio of stocks that then are sold for partial ownership.

- Pension fund - Type of mutual fund that holds assets to provide retirement income.

- Suppose GDP is 18 Trillion. Consumption is 14 trillion and government spending is 1.5 trillion. Taxes are 15 trillion. How much is national savings?

- National Savings = GDP - (Private Spending + Public Spending)

- NS = GDP - (C + I - Taxes + G + Taxes)

- NS = GDP - (C + I + G)

- NS = GDP - $15.5 trillion

- NS = 18 - 15.5 = $2.5 trillion

Warm-up Seventeen:

- Suppose you transfer $5200 from your checking account to your savings account. What has happened to M1 money supply and what has happened to M2 money supply?

Your M1 money supply has decreased, and your M2 money supply has remained the same! This is because the M2 money supply includes the M1 money supply, therefore a change in the M1 money supply will transfer into other regions also included in the M2 money supply, thus resulting in no change.

- What does the store of value function of money mean in terms of money use?

The store of value function of money means money is able to hold its purchasing power.

- What is included in the M1 money supply and what is included in the M2 money supply?

The M1 money supply are the most liquid; it includes traveler's checks, money in circulation, and checkable bank deposits. Or in other words, financial assets directly usable in mediums of exchange.

The M2 money supply includes the M1 money supply, but also near money---which are financial assets that aren't directly usable as a medium of exchange, but can readily and easily be converted (includes time deposits!).

Warm-up Eighteen:

- What is the present value of $3,000 realized three years from now if the interest rate is 5%?

\(PV = \frac{$3000}{(1+0.05)^3}\)

\(FV = $2591.51\)

- If the interest rate is 4%, the amount received one year from now as a result of lending $500 today is ______________.

\(FV = $500\times(1+0.04)^1\)

\(FV = $520.00\)

-

What is the initial effect on the money supply when someone deposits $10,000 in a demand account? Assuming a 10% reserve ratio, how much new money can be created with this transaction?

No effect! This is because money moves from being in circulation to a bank deposit, which are both included in the money supply.

\(New Money = \frac{$10000}{0.1}\)

\(New Money = $100000\)

-

what happens to the money supply when somebody goes to the bank and deposits a check for $500?

No effect! This is because money moves from being in circulation to a bank deposit, which are both included in the money supply.

-

If a bank has $150 million in checkable deposits and the reserve ratio is 10%, what are the excess reserves available for the bank to lend?

\(Reserve = $150\times10^6\times0.1\)

\(Reserve = $15\) million

\(Reserve_{excess} = $135\) million

If a bank has money in its value or on deposited with the Fed, or other assets, that is not excess reserves. Those are required reserves, or other assets the bank owns.

-

Your uncle sends you a $200 check for your birthday and you deposit it into your checking account. The reserve ratio is 10%. Based on this deposit, the bank’s excess reserves have increased by how much? If the bank lends out all excess reserves, the money supply could eventually grow by how much?

\(Reserve = $200\times0.1\)

\(Reserve = $20\)

\(Reserve_{excess} = $180\)

\(New Money = $180\times\frac{1}{0.1}\)

\(New Money = $1800\)

-

First National Bank has $160 million in checkable deposits, $30 million in deposits with the Federal Reserve, $10 million in cash in the bank vault and $10 million in government bonds. Consider the information for First National Bank. If the reserve ratio is 20%, what are the excess reserves available for the bank to lend?

\(160 * 0.2 = $32\) million

\(160 - 32 = $128\) million

-

Explain the structure of the Fed. How is the central bank led? How many district banks are there? What is the Fed’s most important job?

The Fed is made up of:

1. The Chair

Appointed by the President and serves 4-year terms.

2. The Board of Directors

7 members appointed by the government who serve 14-year terms.

3. District Banks

12 banks numbered 1-12 from East to West.

- Helps provide liquidity for regional banks.

- Each has their own presidents.

4. Commercial Banks

They are the "owners" of the Fed, as in they own shares of the Fed.

-

What are the three tools of monetary policy the FED has at its disposal?

1. The Reserve Requirement

A percentage of a deposit a bank can keep---rarely used.

2. Discount Rate

The interest rate charged to banks to borrow from the Fed---somewhat used.

3. Open Market Operations

The buying and selling of government securities from banks---the most frequently used.

- What will the FED do with those tools to expand the monetary base? What will they do to contract the monetary base?

- Decrease the RR, or increase respectively

- Decrease the DR, or increase respectively

- Buying more securities, and vice versa.

-

If a high yield savings account has an interest rate of 5.3%, what is the opportunity cost of holding money in your wallet?

5.3% interest!

-

Is the demand for money positively or negatively tied to the interest rate? What about GDP?

Demand is negatively tied to interest rates. It is positively tied to GDP.

-

What will decrease the demand for money?

Lower aggregate price levels, a decrease in GDP, technology that makes money easier to obtain.

-

At a rate of 4%, borrowers want to borrow $75 billion dollars and lenders wants to lend out $65 billion dollars. What would you expect the interest rate to do? Why?

The interest rates will increase. This is because there is a higher demand for money than supply, thus the interest rate will increase to match this higher demand.

-

What are the factors that would increase the demand for loanable funds?

Changes in perceived business opportunities

Changes in the government’s borrowing

Crowding out (ON TEST!) - Has the result of raising the interest rate.

-

What are the factors that would reduce the supply of loanable funds?

Changes in private savings behavior

Changes in capital inflows

Warm-up Twenty-one:

- When the budget is in deficit, what does the government generally do to make up the difference?

- Stop spending money (reduce government spending)

- Raise taxes

- Print more money

- Borrow

- As the economy expands, what happens to the budget? Why?

- Smaller deficit or even surplus. This is due to the increased tax revenue and decreased transfer payments.

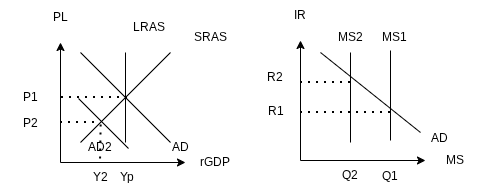

- During an inflationary gap, what should the Fed do to monetary policy? What will this do to interest rates and AD? Graph it.

- Use contractionary Monetary Policy.

- Sell bonds

- Increase RR

- Increase DR

- AD will shift leftwards and interest rates will decrease.

- Use contractionary Monetary Policy.

- Should the Fed purchase or sell government bonds to fight a recessionary gap? Why? What will be the result? Graph it.

- Buy bonds which helps increase the money supply.

- The aggregate demand increases.

Warm-up Twenty-two:

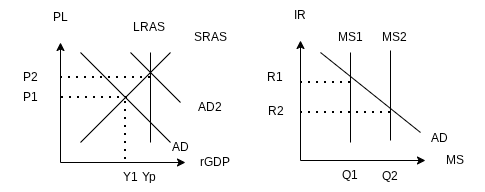

- To fight inflation, what open market operation should the FED conduct? What happens to the I.R.? How does this affect price level and GDP (output)? Graph the effect of this monetary policy using a money market and AD/AS graph.

The FED should sell bonds. This will reduce the money supply and causes the interest rate to rise. The aggregate demand would then shift towards the left. The price level and GDP will also fall as a result.

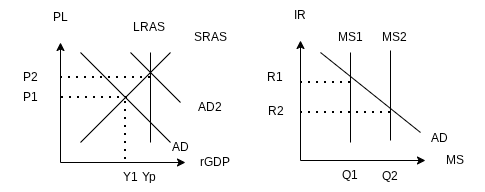

- To boost an underperforming economy, what open market operation should the FED conduct? What happens to the I.R.? How does this affect price level and GDP (output)? Graph the effect of this monetary policy using a money market and AD/AS graph.

The FED should buy bonds. This increases the money supply and causes the interest rate to fall. This in turn would shift aggregate demand to the right. The price level and GDP will rise as a result.

-

Graph an increase in the money supply using a money market graph. What will be the effect on interest rates? What will be the effect on aggregate demand? Show it using an AD-AS graph. In the long run, what happens to price level and what happens to the demand for money.

-

Describe the relationship between unemployment and output gaps (both inflationary and recessionary)

When there is an inflationary gap, unemployment is lower than the natural rate. When there is a recessionary gap, unemployment is higher than the natural rate.

-

What happens when governments print money to make up their budget deficits?

- Raise Taxes

- Cut spending

- Borrow

- Print Money

Inflation increases thanks to an increase in the money supply.

Seigniorage - Practice of the government printing money.

Also known was monetizing the debt.

It creates an inflation tax - a tax on individuals who hold a lot of cash, savings accounts, bonds. Any accounts with nominal interest rates will be negatively effected.

-

Review the factors that increase and decrease AD and AS. Graph each one. Shift the appropriate curve. Complete this table…

| Inflation | Unemployment | |

|

AD Increase  |

||

|

AD Decrease  |

||

|

AS Increase  |

||

|

AS Decrease

|

Warm-up Twenty-Five:

Open Market Purchases (Graph) What happens to interest rates? How does this affect AD (output) and price level?

Output increases

PL increases

Open Market Sales- What happens to interest rates? How does this affect AD (output) and price level?

Output decreases

PL decreases

When to conduct expansionary monetary policy?

When there is a recessionary gap.

When to conduct contractionary monetary policy?

When there is an inflationary gap.

When the government decides to increase or decrease taxes to close an inflationary or recessionary gap, what is this called?

Discretionary fiscal policy.

What is the Phillips Curve? What does it show?

The Phillips curve shows the relationship between inflation rate and unemployment rate. They have an inverse relationship.

Warm-up Twenty-Six:

rGDP = \(\frac{108-100}{2}\) = 4

What promotes long run economic growth?

- Productivity

- Human Capital (Education)

- Technology

- Physical Capital (Machinery)

Double = \(\frac{70}{5}\) = 12 years

Explain how countries that lack abundant antural resourcecs have high GDP per captal, but cuntries with abundant natural resouces have very low GDP per capita.

Countries with abundant natural resouces can have low GDP per capita when they have low productivity and high populations. The opposite can be true for lacking natural resource countries where their sheer productivity and low populations help boost GPD per capita.

Ex. Japan vs Nigeria:

Japan - Politically sound, technology-based, good infrastructure.

Nigeria - Politically turbulent, poor infrastructure.

What does the aggregate production function show us? Why is this important?

The aggregate production function shows us the relationship between rGDP and its four inputs: Productivity, Human Capital, Physical Capital, and Technology. This is important because all the graphs show a positive relationship, therefore we can conclude rGDP is proportional to those.

Why are technological advances so important to long run economic growth?

Technological advances are significantly benefit efficiency. If an economy does not have technological advances, growth will be very slow as productivity will be very low thanks the inefficiency. For certain productions, it could be impossible altogether without certain technologies.

Warm-up Twenty-Seven:

What are three examples of infrastructure?

- Transportation networks (trains, roads, bridges, etc.)

- Communicative services (broadband, telecom, etc.)

- Utility/public services (electric grids, water, etc.)

What is the correlation between LREG and political and social stability?

The two are proportionally related.

Graph the LREG on AD/AS and PPC.

- AD/AS has both AD and AS shifting towards the right, followed by the LRAS doing the same.

- PPC expands outwards.

Warm-up Twenty Eight

What are the current and financial accounts used for? What is included in each?

Current and financial accounts are used to track transactions between countries. Current accounts is the difference between the sale and purchase of goods and services, while financial accounts is the difference between the sale and purchase of assets.

If the US dollar appreciates, what happens to american exports? If the US dollar depreciates, what happens to american exports?

If the US dollar appreciates, American exports decrease. This is because it now costs more for other countries to import America goods thus they are less willing to. The opposite is true for a depreciation of currency, the exports will increase.

Suppose interest rates in America go up. What can we expect to happen to capital flows? What happens to the value of the USD? (appreciate or depreciate?)

Capital flow will increase. This is because foreigners are more willing to invest in the US thanks to the greater return as a result of the higher interest. The value of the USD will appreciate.

Warm-up Twenty-nine

If a government fixes the exchange rate of their currency above equilibrium, will there be a shortage of surplus? Why would a country opt for one?

There will be a surplus. A country would opt for a fixed exchange rate to fight inflation.

Expansionary monetary policy tends to do what to the interest rate? What does this cause the dollar to do?

Tends to increase the interest rate. This causes the dollar to appreciate.

What can a tariff do that a quota cannot?

Tarrifs allows a conutry to make additional money from imports to a theoretically infinite extent, while quotas will be limited.

What would be the result of a protective tariff on motorcycles?

It would increase the local economy/demand on the in-country motorcycles, protective/guarenteeing their sale.

No comments to display

No comments to display